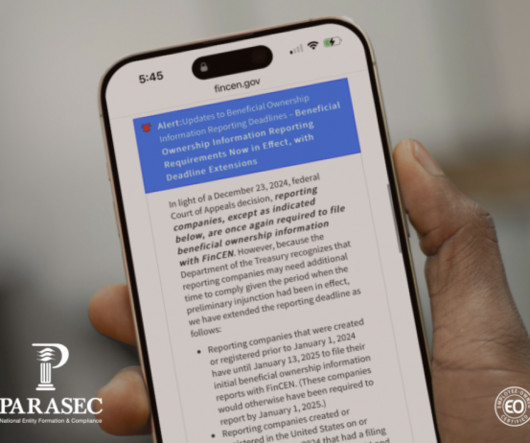

CTA Update – BOI Reporting Requirements Now in Effect, with Deadline Extensions

Parasec

DECEMBER 23, 2024

The new reporting deadlines are as follows (per the notice on the FinCEN website): Existing companies (formed before January 1, 2024) have untilJanuary 13, 2025, to fulfill their BOI reporting obligations. Reporting companies that qualify for disaster relief may have extended deadlines that fall beyond January 13, 2025. Yellen, No.

Let's personalize your content